Health is the biggest wealth that any human being can have in their entire life. But access to quality health services is a huge challenge globally with most people in Africa and Asia unable to get dignified healthcare.

But, some steps are being taken to address these glaring health services disparities. While governments, the private sector and development partners are investing massively in health infrastructure, innovators are also playing their part; ideating, developing and rolling out solutions to democratize healthcare. Among such companies is Afya Lead.

Founded at the end of 2020, Afya Lead uses FinTech to provide affordable technologies and medical devices to improve the quality of healthcare in Africa.

“Currently, we are ensuring the accessibility, availability and affordability of Healthcare through innovative solutions that bring seamlessness and convenience to Healthcare in Africa. We are working on two products. One is Mkanda Salama; which is a Swahili name for Safe Belt. It is a locally made tool designed to stop bleeding among mothers with excessive bleeding immediately after delivery,” Franc Mussa, the Chief Strategy Officer at Afya Lead noted.

He added: “The second product is Pamoja Bima; a mobile Micro health insurance that aims at increasing access to health insurance among people from the informal sector in rural Tanzania. This we implement with health insurance schemes across Tanzania. Pamoja Bima is available on both IOS and Google Play store. After downloading the APP, you register and then see the available insurance schemes from which you select the premium you need and pay.”

According to Mussa, Afya Lead is contributing immensely to ensuring that every person has access to quality health services. But not without challenges.

“This is a new technology we have introduced. The main challenge is transforming the mindset of our end-users to accept technology. We are investing a lot in transforming the mindset of our African audience. The other challenge is regulations. While we are using Technology to solve a Healthcare problem, we are restricted by harsh regulations.”

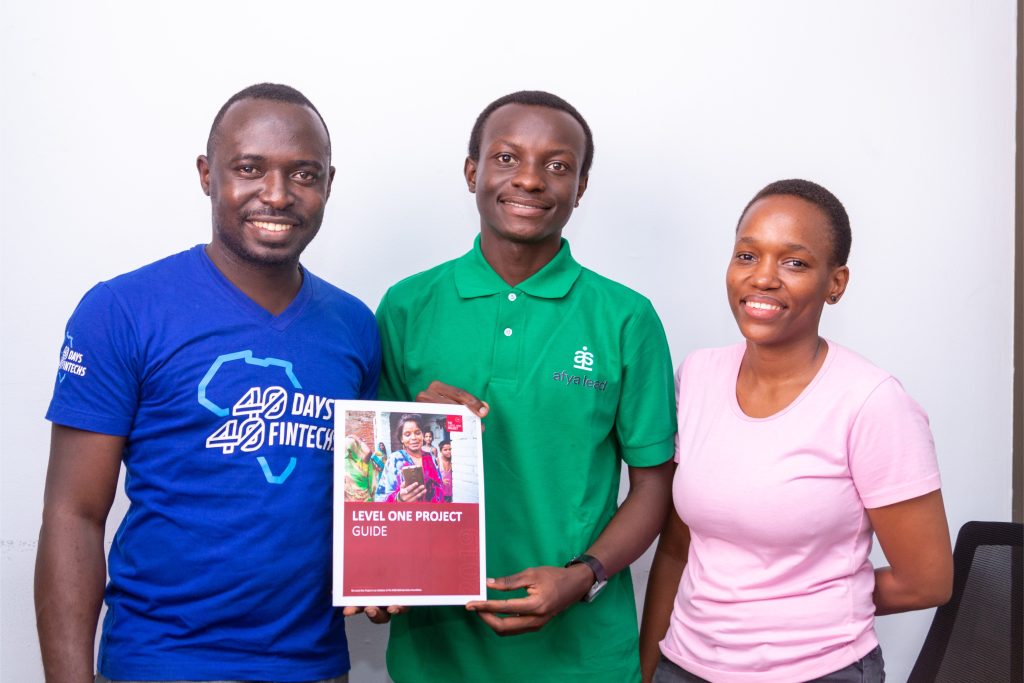

Afya Lead interacted with the HiPipo Team on Day 11 of the 40 Days 40 FinTechs initiative for Tanzania. First implemented in Uganda, 40 Days 40 FinTechs is an annual FinTech Innovation initiative presented by HiPipo to recognize and celebrate individuals and organizations who are making significant strides in promoting financial inclusivity through the use of technology.

It is aimed at promoting innovation and collaboration among FinTechs in Africa. The initiative is designed to provide FinTechs and startups with mentorship, training, exposure, and networking opportunities to help them grow and scale their businesses.

“Initiatives like 40 Days 40 FinTechs are very important on the African continent. Through this initiative, we air our views and suggest ways of improvement. These views are then forwarded to the regulators and policymakers for consideration. I think that 40 Days 40 FinTechs should not be happening once a year. It should be done regularly to ensure that policymakers are continuously reminded about the challenges that start-ups and local innovators are facing,” Mussa explained.

40 Days 40 FinTechs initiative Tanzania is part of HiPipo’s broader Include EveryOne Program that is generously supported by the Gates Foundation and implemented in partnership with Level One Project, ICTC Tanzania, Ideation Corner, Cyber PLC Academy, INFITX, NG Films, Founders Academy and Mojaloop Foundation.

The Include EveryOne program is a beacon of acceleration of FinTech Innovation, empowerment for Women in FinTech and a catalyst for investment and development in the ICT sector. Minus 40 Days 40 FinTechs, other initiatives under the Include EveryOne Program are the FinTech Landscape Exhibition, Women in FinTech Hackathon, Summit and Incubator, Digital Impact Awards Africa and the Digital and Financial Inclusion Summit.

HiPipo is recognized as a premier advocate of digital Innovation and financial inclusion champion, a fervent proponent of the #LevelOneProject. HiPipo has been at the forefront, actively promoting digital innovation, Instant, Inclusive Payment Systems (IIPS), and DFS across Africa. With a legacy of advising, mobilizing, and facilitating the adoption of inclusive financial services, HiPipo’s efforts have been nothing short of transformative! For almost two decades, HiPipo has successfully facilitated the inclusive adoption of these crucial services.