On average, corporate organizations spend at least Shs 80,000 annually on every employer to buy paper cards, popularly known as business cards. Sadly, when these people go out to network and give out paper cards, most of these cards end up in one’s pockets or laundry baskets the following day.

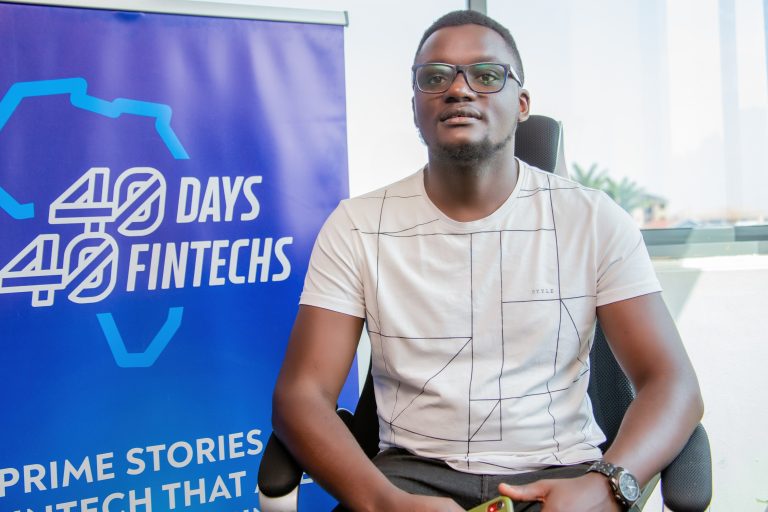

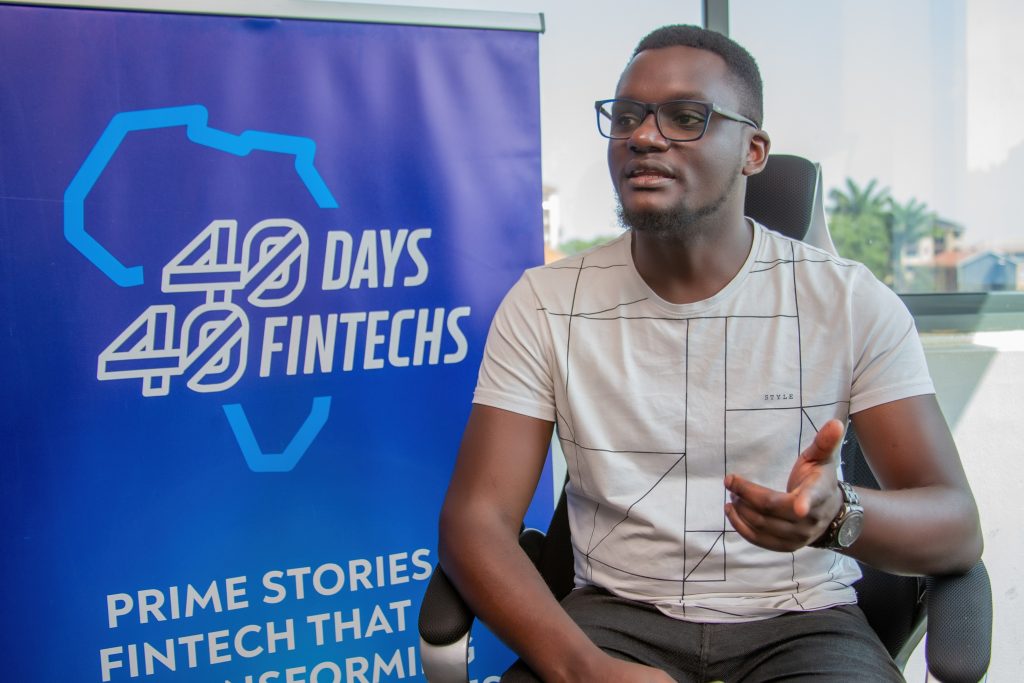

It’s against this background that Joshua Mulwana, through his digital agency called Malticard, innovated a digital business card that uses near-field communication where you just tap it on one’s phone and you share your contact details with them.

Mulwana says that with this card, you do not need a cardholder or to move with countless business cards because it can help you transfer contacts digitally.

“Our card is more than a business card. It is an access control card. The same card can be used for accessing the office by clocking in and out or working as a company ID. Some people are rigid and want to stay with their old systems. We want to change that,” Mulwana explains.

He further adds that while business penetration has been a big challenge, they have managed to get more than 1,200 customers to subscribe to this card. Anyone interested in this card just logs onto malticard.com and signs up to create an account.

“When we receive your request, we call you and ask for your business details such as a logo…If you have a logo, we ask for it and if it’s not good, we improve it. We give you a copy of the sample and if you give it a green light, we produce and deliver it for free,” says.

“Our card goes for Shs 45,000. It comes with one month’s subscription and afterwards, you begin paying Shs 1,000 monthly or Shs 12,000 annually via your account through mobile money or a bank card,” he adds.

Besides the digital business card, Mulwana says that they also have Smart Wallets that prevent people from fraudsters copying information off their credit cards.

“We also have School Time that helps to keep track of who has picked a child from school. Then there is a ticketing system that we install at stadiums to help keep track of the funds [from] match-day ticketing. We are currently working with KCCA FC,” he says.

With over 3,000 subscribers to their products, Mulwana says the future looks bright. He is, however, concerned about the reluctance by corporate organisations to embrace digital systems.

He also highlights operational funds as a limit to their growth.

“Like any other startup, operational funds limit the way you are going to spread out to new organizations. The number of smartphones among Ugandans is increasing and it is a plus for us. However, on the other end, data bundles are expensive compared to our neighbours like Rwanda and Tanzania. This limits internet usage yet most of our innovations require internet to access them,” he says.

He however commends telecom companies and phone companies for creating cheap smartphones that are fairly accessible to ordinary populations. On integration, Mulwana says they have tried to work with telecoms but they remain very bureaucratic yet it is easier to work with other payment gateways like Flutterwave. He sends special thanks to HiPipo for giving startups a space where they can easily get known by other people, learn and further improve their innovations.